Secure Debit Order Solutions.

Clear Pay empowers your business to collect, manage, and scale recurring payments with ease. Whether you’re an SME or a large enterprise, our PASA-compliant debit order solutions help you collect faster, safer, and smarter.

Ready to get started? Contact us!

Schedule a free, no-obligation consultation — we’d love to show you how our products work and answer any questions you have.

Benefits

PASA Registered

Being PASA-registered means our organisation is recognized and compliant with South African National Payment System (NPS) regulations.

POPIA & FICA Compliant

Being POPIA and FICA compliant in South Africa provides crucial legal, operational, and reputational benefits to companies.

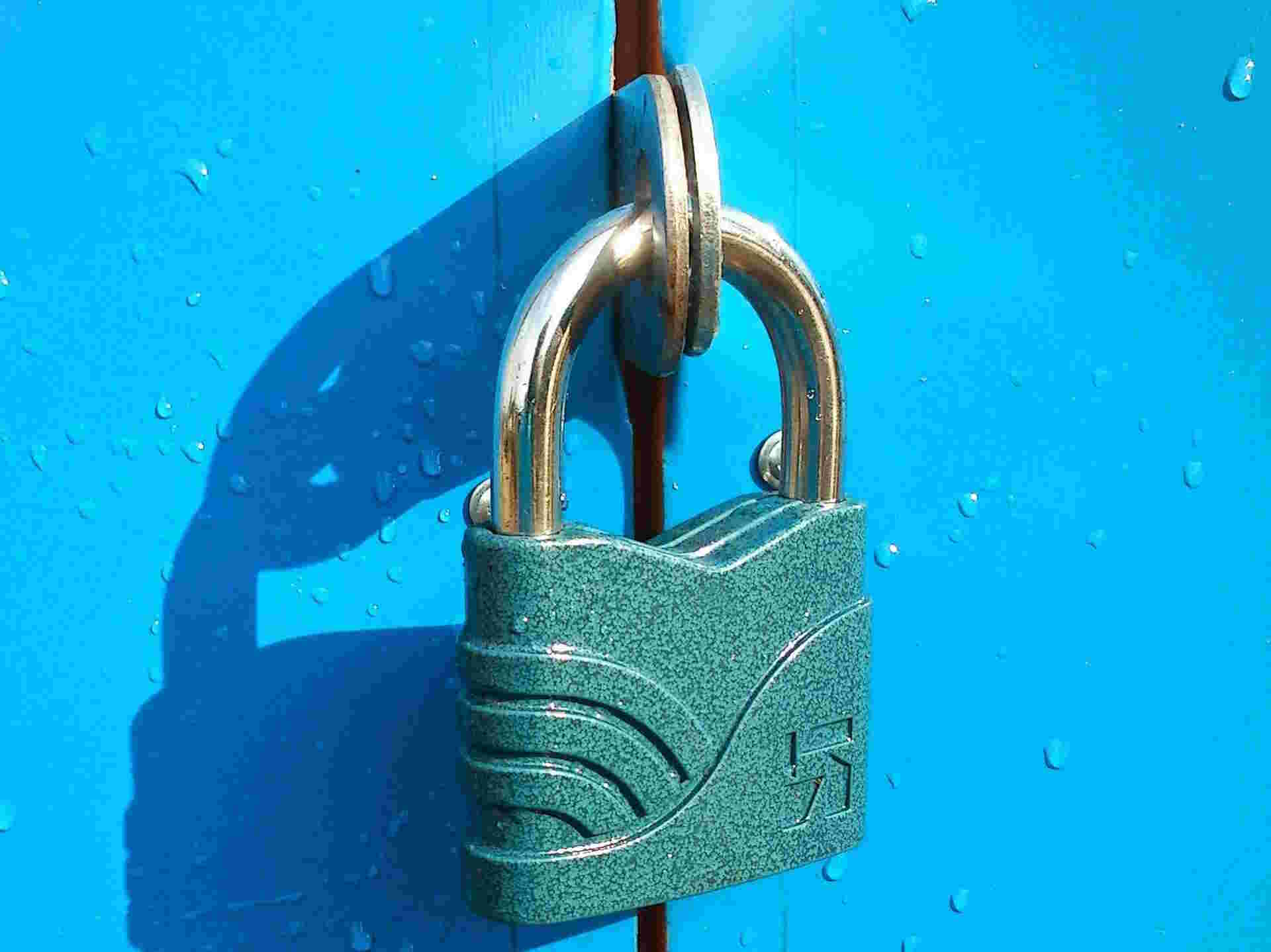

Security & Encryption

Bank-grade security and encryption offers crucial benefits to payment providers, especially in terms of trust, compliance, risk reduction.

B-BBEE Level 1 Contributor

Partnering with a Level 1 vendor strengthens your own bid compliance, giving you a competitive edge in tenders and contracts.

Technology Driven

Our platform combines robust compliance, seamless integrations, and user-centric features to power your business’s recurring payments.

View profileIndustries

Insurance &

Financial Services

Automated Collections That Protect Your Clients and Your Compliance.

Use Cases: Life, funeral, and health insurance premiums; Micro-loans and repayments

Education &

Online Tuition

Secure, Structured School Fee & Student Payment Management.

Use Cases: Monthly tuition and transport fees; Exam registration fees; Multi-child discount logic; Recurring and once-off payments.

Medical &

Healthcare

Stable Collections for Clinics, Practitioners, and Medical Schemes.

Use Cases: Medical aid top-ups or gap cover; Counselling and therapy subscriptions.

NGOs &

Churches

Support Your Cause. We’ll Support Your Contributions.

Use Cases: Monthly debit orders for donations or tithes, SMS-enabled pledge payments, recurring debit authorisation via mobile, low-cost plans for verified NPOs.

Real Estate &

Rentals

Reliable Rental Collections. Happier Tenants. Fewer Arrears.

Use Cases: Monthly rent or levy collections, DebiCheck-protected leases, early debit timing for payday targeting arrear collection strategies via EnDO.

Subscription & SAAS

Recurring Billing Built for Scale.

Use Cases: Software-as-a-Service platforms, digital subscriptions (education, wellness, content);

Usage-based billing cycles, membership renewals with smart retry logic.

Supercharge Your Collections

Unlock your business’s full potential with Clear Pay’s revolutionary debit order and payment solutions—secure, PASA-compliant, and engineered for explosive growth!

Say goodbye to payment headaches, disputes, and delays as you collect faster, smarter, and safer than ever, backed by 99.99% uptime, ironclad fraud protection, and seamless integrations that supercharge your cash flow.

FAQ

Clear Pay serves a wide range of industries across South Africa, helping businesses and organisations collect recurring payments reliably, securely, and compliantly.

Clear Pay offers transparent, scalable pricing built to suit businesses of all sizes — whether you’re processing a few transactions a month or thousands. Choose the model that works for you, with no hidden fees and full support included.

When it comes to recurring payments, compliance, and cash flow, trust matters. Clear Pay is not just a payment processor — we’re a partner in your growth, committed to uptime, transparency, and exceptional service.

Whether you’re new to debit orders or an experienced finance team integrating our API, Clear Pay offers a library of tools to help you succeed. Access guides, documents, answers, and expert content — all in one place.

Testimonials

Since switching to Clear Pay, our collection success rate has improved dramatically. The onboarding…

Sipho M

The platform is slick, the support is top-tier, and we’ve finally eliminated chargebacks.

Melissa K

We needed DebiCheck fast and Clear Pay delivered. Onboarding was smooth, and their API plugged stra…

Thabiso R

News & Events

-

What Is DebiCheck? Why It Matters in 2025

In South Africa’s evolving financial landscape, DebiCheck stands out as a crucial tool for se…

-

The Top 5 Mistakes SMEs Make with Debit Orders

In South Africa’s competitive business environment, debit orders remain a vital tool for SMEs…

-

Understanding POPIA in Your Payment Flows

In South Africa’s rapidly digitising financial sector, the Protection of Personal Information…

-

How to Optimise Strike Dates for Better Collection Rates

In South Africa’s dynamic payments ecosystem, optimising strike dates for debit orders is ess…